Bonus Depreciation 2024 Percentage

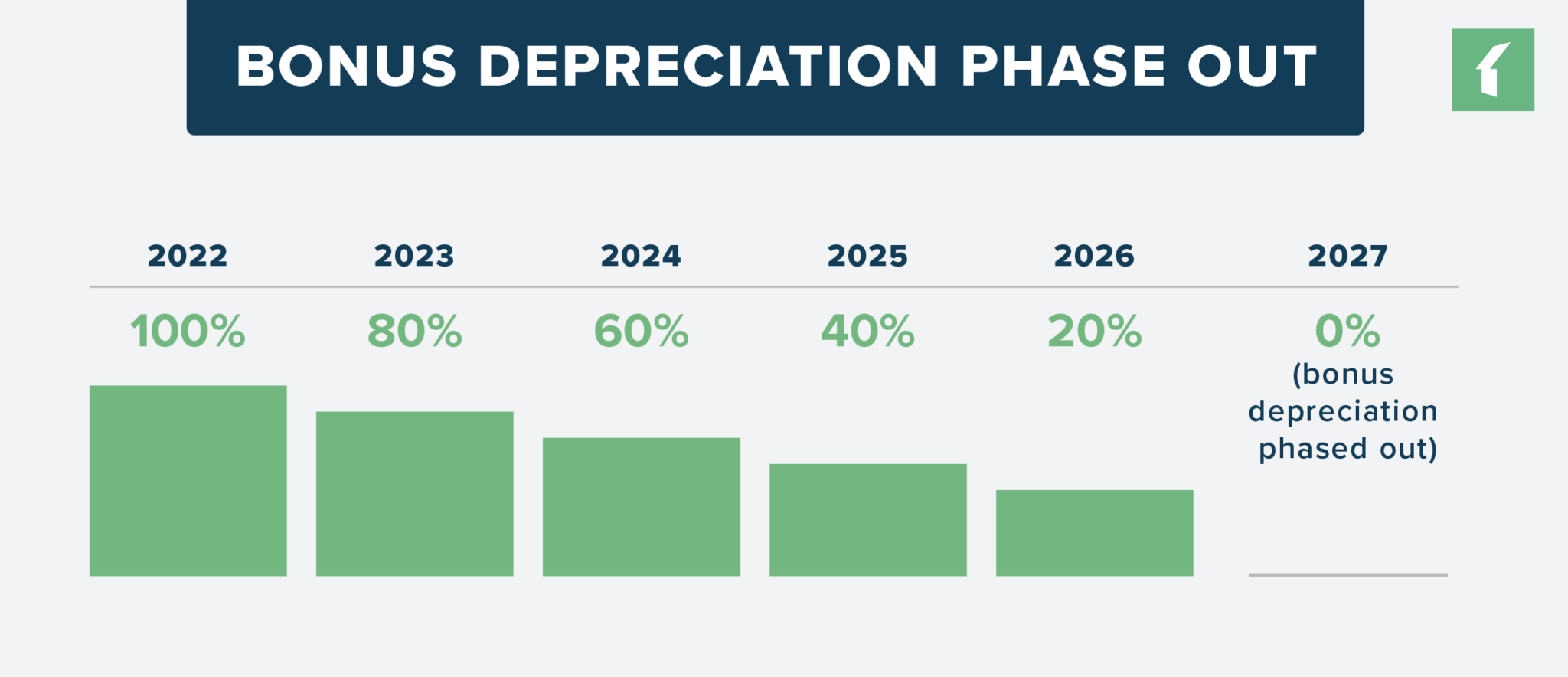

Bonus Depreciation 2024 Percentage. This rate will continue to decrease by 20% per year until it is completely phased out in 2027, unless congress takes. The bill includes 100% bonus depreciation, allows for immediate research and development expensing and expands the child tax credit.

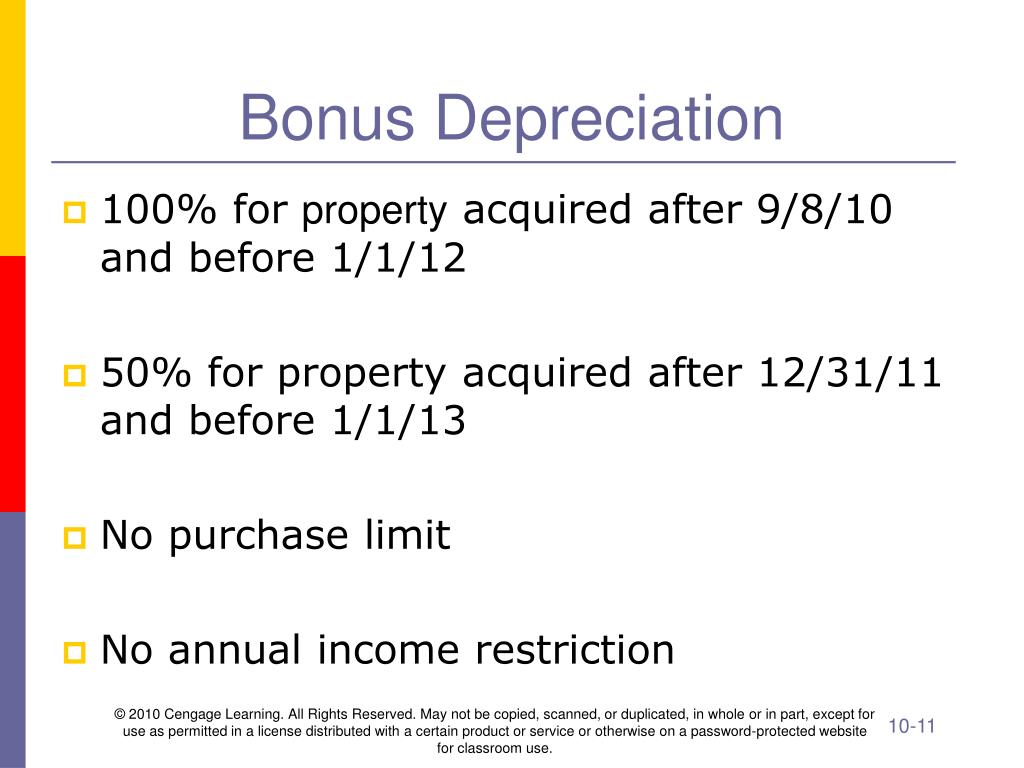

Bonus depreciation comes into play after the section 179 deduction limit is reached. One of the most significant provisions of the tax cuts and jobs act.

Bonus Depreciation 2024 Percentage Images References :

Source: ninonqfrances.pages.dev

Source: ninonqfrances.pages.dev

Bonus Depreciation 2024 Percentage Change Ted Shantee, Overview of bonus depreciation in 2024.

Source: ardeliswfedora.pages.dev

Source: ardeliswfedora.pages.dev

2024 Bonus Depreciation Percentage Calculator Selle Danielle, In 2024, the maximum bonus depreciation percentage will be 60%.

2024 Bonus Depreciation For Vehicles Caryn Cthrine, What are the eligibility requirements for the additional first year depreciation deduction following the enactment of the tax cuts and jobs act of 2017 (“tcja”)?

Source: gaelbalfreda.pages.dev

Source: gaelbalfreda.pages.dev

2024 Bonus Depreciation Rates Dannie Kristin, The bill includes 100% bonus depreciation, allows for immediate research and development expensing and expands the child tax credit.

Source: cathyleenwchanna.pages.dev

Source: cathyleenwchanna.pages.dev

2024 Vehicle Bonus Depreciation Debi Mollie, This guide offers a detailed look into the mechanics and strategic application of bonus depreciation in 2024, particularly focusing on new developments and how businesses can best.

Source: veronikawflo.pages.dev

Source: veronikawflo.pages.dev

2024 Bonus Depreciation Percentage Table Nelie Xaviera, This guide offers a detailed look into the mechanics and strategic application of bonus depreciation in 2024, particularly focusing on new developments and how businesses can best.

Source: liaqhesther.pages.dev

Source: liaqhesther.pages.dev

Bonus Depreciation Rate For 2024 Aleda Aundrea, This rate will continue to decrease by 20% per year until it is completely phased out in 2027, unless congress takes.

Source: danicaqlisetta.pages.dev

Source: danicaqlisetta.pages.dev

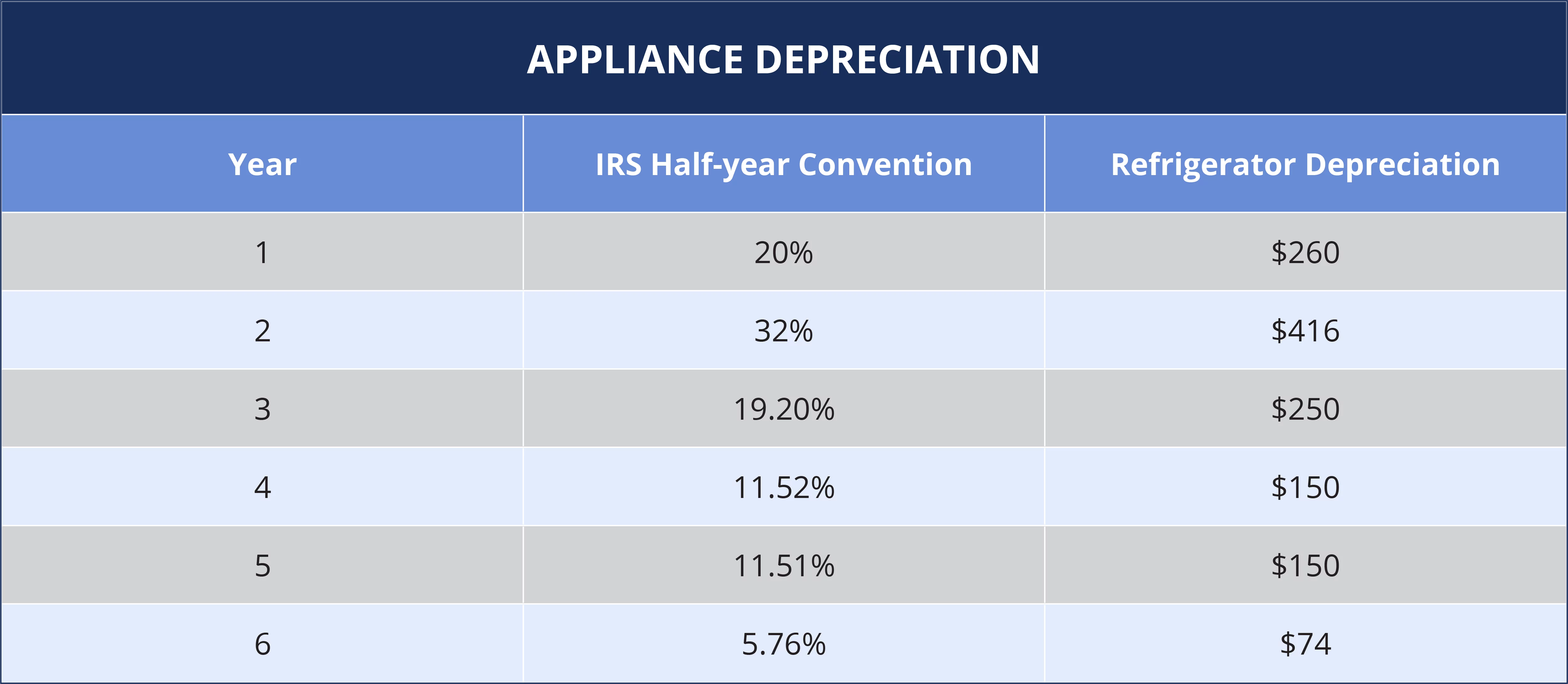

Bonus Depreciation 2024 Percentage On Rental Dehlia Layney, Personal property typically has a depreciation period of fewer than 10 years when used inside rental property.

Source: ceceliawabbie.pages.dev

Source: ceceliawabbie.pages.dev

2024 Bonus Depreciation Percentage Chart Rana Kalindi, Personal property typically has a depreciation period of fewer than 10 years when used inside rental property.

Source: www.ssacpa.com

Source: www.ssacpa.com

Don’t miss out on bonus depreciation before it's too late Sol Schwartz, For 2023, businesses can take advantage of 80% bonus depreciation.

Category: 2024